- November 30, 2021 |

- webdev |

- Bookkeeping

When you estimate daily returns, you choose daily frequency, whereas weekly returns require weekly frequency. And similarly, you select ‘monthly’ when calculating monthly returns. Let’s use Yahoo Finance because it’s one of the most popular websites regarding accessible stock market data.

If the rate takes a negative form, we have a negative return, representing a loss on the investment, assuming the amount invested is greater than zero. Withdrawing a large chunk of change at this time can destroy a portfolio and make it impossible to recover when the good market years show up. The problem, however, is that this thinking did not address the sequence of returns risk. That said, the math also shows that the vast majority of retirees should be able to increase their withdrawal rate over time, to 4% or higher.

The Compound Annual Growth Rate (CAGR) is another metric that shows the annual growth rate of an investment, but this time taking into account the effect of compound interest. The rate of return (ROR) is a simple to calculate metric that shows the net gain or loss of an investment or project over a set period of time. In finance, a return is a profit on an investment measured either in absolute terms or as a percentage of the amount invested. Since the size and the length of investments can differ drastically, it is useful to measure it in a percentage form and compute for a standard length when comparing.

Returning to our example, if Apple realizes three annual returns of 30, 25, and -20%, its mean return is 11.7%. In this formula, R is the return in a given period (t), while the capital T is the total number of periods. Keep reading to learn how to calculate the rate of return in Excel with a practical example. Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more. Return on investment calculator is a tool for everyone who has got a business or is planning to set one up.

This is also highly recommended for any investors, from shopkeepers to stockbrokers. As an investor in the real estate market, you purchase a property in New York for $600,000. Investors can’t estimate the efficiency of their investments without what causes a tax return to be rejected understanding how to calculate ROI. That’s why the ROI formula plays a crucial role in investment decisions. The IRR needs to be higher than the company’s required rate of return in order for the company to move forward with the project.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

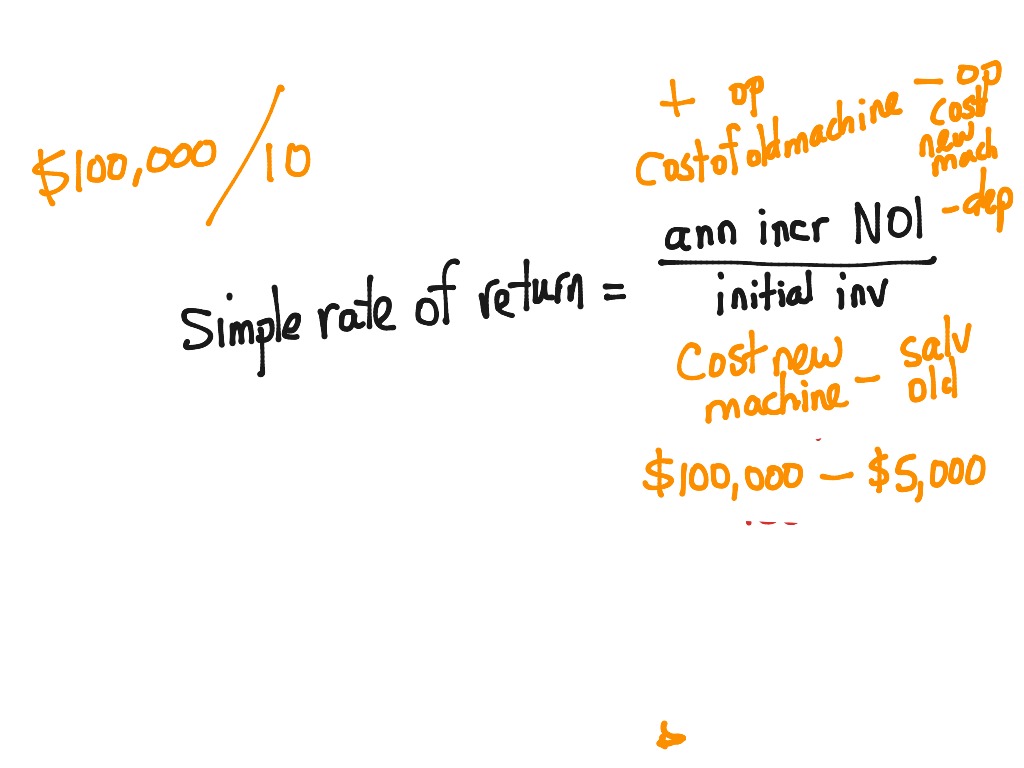

Because it takes into account both current income and capital gains, it can be used to find the true returns of different types of investments. If calculated correctly, your rate of return will be expressed as a percentage of your initial investment. Positive rate of return calculations indicate a net gain on your investment, while negative results will indicate a loss. A rate of return (RoR) is the net gain or loss of an investment over a specified time period, expressed as a percentage of the investment’s initial cost. When calculating the rate of return, you are determining the percentage change from the beginning of the period until the end. The accounting rate of return (ARR) formula divides an asset’s average revenue by the company’s initial investment to derive the ratio or return generated from the net income of the proposed capital investment.

On the other hand, multiple-period returns can be determined in different ways. An ROI (return on investment) of 30% means that the profit or gain from an investment is 30%. For example, if the investment cost is $100, the return from investment is $130 – a profit of $30. The main difference between ROI and ROE is that the former takes into account the total expenditure on investments (this is own capital and debt), whereas the formula of the latter includes only own capital. As return on investment (ROI) is sometimes confused with return on equity (ROE), it is worth briefly discussing the similarities and differences between them.